ArcelorMittal Tubular Products Jubail (AMTPJ), supported by its major shareholders the Public Investment Fund (PIF) and ArcelorMittal, has completed the acquisition of Jubail Energy Services Company (JESCO)

With reference to Saudi Vision 2030, ArcelorMittal Tubular Products Jubail (AMTPJ) has completed the acquisition of Jubail Energy Services Company (JESCO). Following the completion of a capital increase in relation to the acquisition, the Public Investment Fund (PIF) will have majority ownership of AMTPJ.

AMTPJ and JESCO will continue to remain independent of one another, although opportunities to reduce costs through shared services (such as IT and Finance) will be explored in the coming weeks and months.

All stakeholders are being kept informed of activities, and this transaction has been approved by the General Authority for Competition.

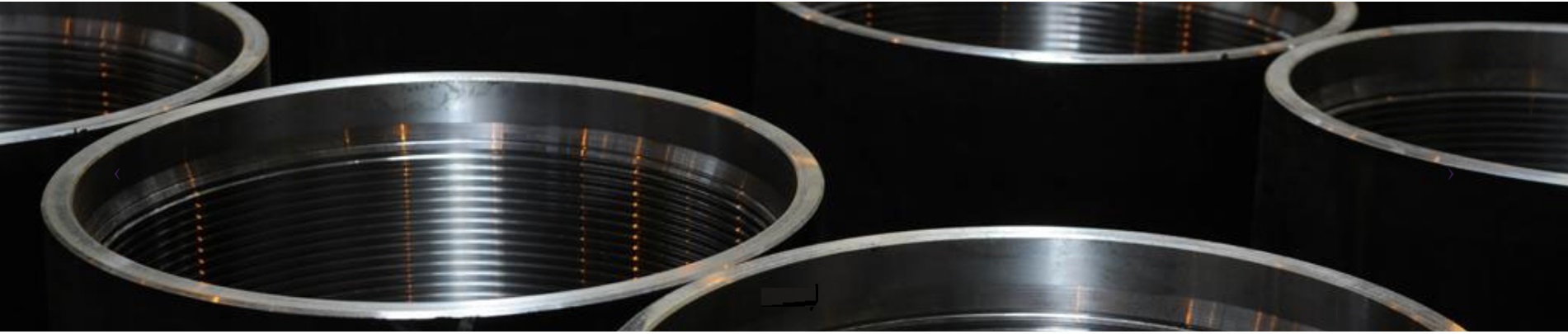

This transaction will help both firms to further expand their vision to become leading, premium SMLS manufacturers, better serving the current market outlook & economic conditions in the region and contributing to the realization of the Kingdom’s 2030 Vision of growth, empowerment, and leadership.

AMTPJ CEO Gabriel Monti said:

“Combining AMPTJ with JESCO creates a new regional champion capable of delivering first-class products and services to our expanded customer base. We fully intend to capture the multiple synergies associated with this combination which will further strengthen our competitiveness. I would like to thank all employees from both companies for the patience and commitment they have shown throughout this transaction process. Their professionalism has been exemplary, and I am confident they will feel tangible benefits from this transaction. I’d also like to thank the Ministry of Investment of Saudi Arabia for the enabling role it played in facilitating this transaction.”